RBC Alternate Mortgage System

The success of our launch of Lendesk’s Lender Network, a platform that allows licensed mortgage brokerages to file applications directly with lenders, proved to be attractive to mortgage brokers. We signed a statement of work to provide RBC’s alternative lending division with an integration to their traditional mortgage platform (LINK). This integration automatically ingested mortgage applications from customers referred to RBC’s alternative mortgage specialists. These specialists could then take advantage of Lendesk’s mortgage workflow platform and effortlessly submit those applications to Lendesk’s Lender Network, including Scotiabank, First National, CMLS, Equitable Bank, and the Paradigm Quest group of lenders. Brokers would be able to securely pull credit from Equifax and TransUnion and submit their files seamlessly.

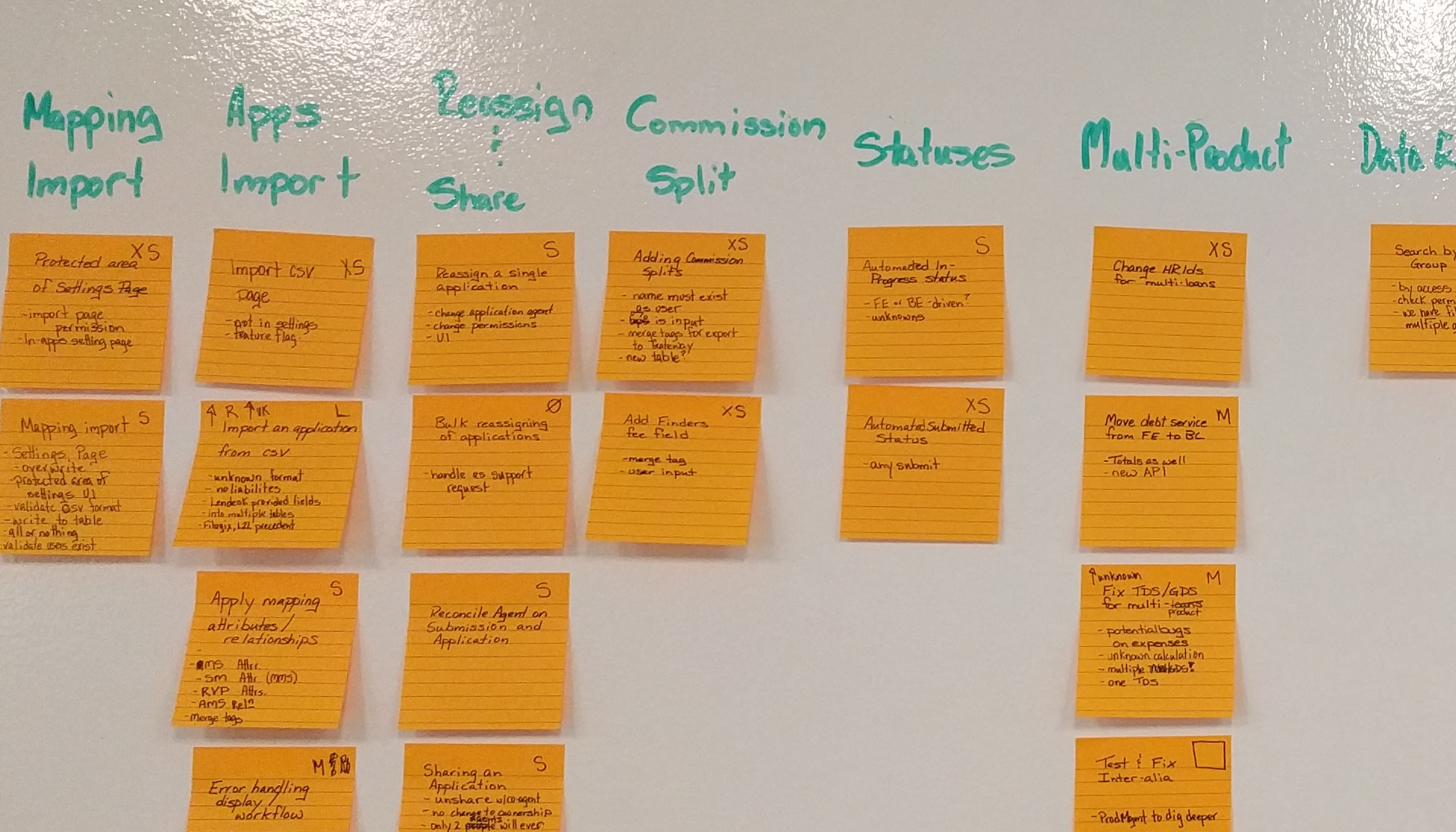

Lendesk had never undertaken a project of this size. Through a series of on-site meetings in Toronto with RBC, the working group, with me playing a major role as VP of Engineering, established a set of agreed-upon requirements. Those requirements were brought back to Lendesk for the next steps of the project. With experience delivering projects of this scale, I organized and led a week-long workshop, breaking down those requirements into high-level epics, identifying risks, capturing assumptions, making high-level architecture decisions, and estimating the project’s duration with other senior Product and Engineering leaders across all teams. This was a company-wide, high-stakes project for Lendesk and our first major win with one of Canada’s Big 5 financial institutions.

Thus began a 7-month project for RBC, running in parallel with Lendesk’s ongoing Lender Network integration expansion and SMB brokerage products. I continued to work hands-on with the participating teams, mitigating risk, making design decisions, liaising between RBC and Lendesk, maintaining the quality of the output, managing the Directors and Leads, and communicating our progress.

User Acceptance Testing began in late November with a successful outcome. In the new year, RBC went live with their new alternative mortgage platform—on time and on budget. Due to the success of this enterprise-sized project, we soon began discussions with CIBC for a similar solution.

Today, Lendesk provides solutions to 4 of the 5 Big Banks in Canada, who are using our Digital Solutions for Financial Institutions. Lendesk now offers the leading “plug-and-play” digital mortgage experience for brokerages, big banks, and credit unions in Canada.